Negative customer experiences are costing businesses trillions. In our latest global consumer study, Qualtrics XM Institute asked nearly 24,000 people across 23 countries about their recent experiences with organizations in 20 different industries. For those who had a very poor experience, we asked how the negative interaction(s) affected their spending behaviors and then calculated the resulting financial impact on each industry1. Our analysis reveals that:

- Governments disappoint the most. Consumers reported experiencing a bad customer experience most often with government agencies (22%) and least often with supermarkets (4%).

- Fast food loses the most sales. After a bad experience, consumers are most likely to stop or decrease spending with fast food restaurants (66%) and least likely to cut back their interactions with public utilities (41%).

- Automotive dealers shed the most customers. After a bad experience, consumers are most likely to stop doing business completely with an auto dealer (23%) and least likely to stop doing business with supermarkets (7%) and public utilities (9%).

Calculating the Cost of Bad Experiences Across 23 Countries

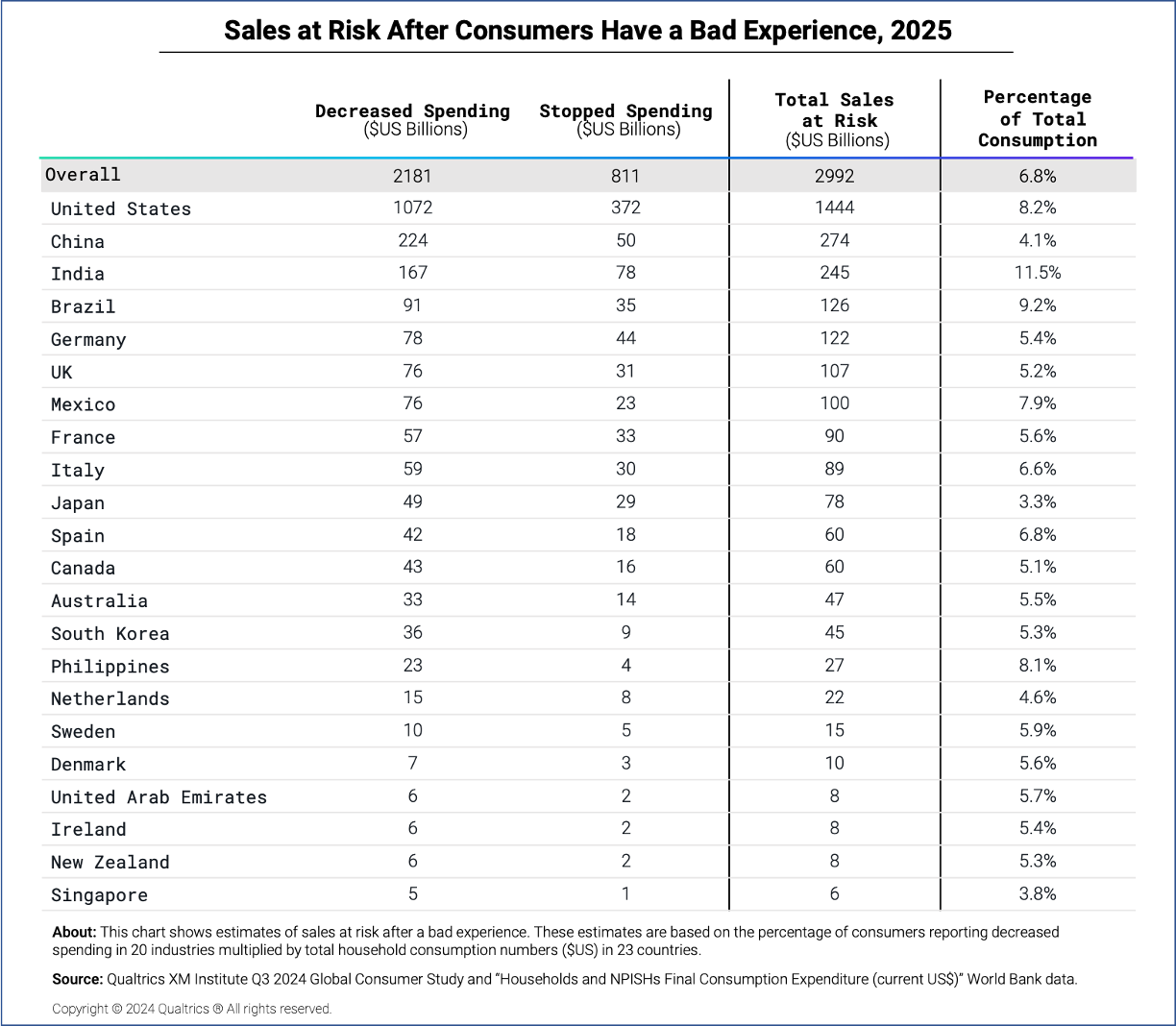

Using the data from both this study and the World Bank, we estimate that organizations within the 23 countries included are putting a whopping $3 trillion of their sales at risk. To calculate this number, we measured:

- Frequency of bad experiences. Consumers report very poor experiences after 12% of interactions. Across countries, this ranges from a low of 7% in Japan to a high of 31% in India.

- Spending changes after a bad experience. Consumers decreased spending after 38% of very poor experiences, while consumers stopped spending with a company entirely after another 15% of negative experiences. The percentage of consumers who either reduce or stop spending with a company ranges from a low of 37% in China to highs of 67% in Spain and 70% in Hong Kong (China).

- “Sales at risk” (percentage). By multiplying the percentage of poor experiences and the percentage of consumers who have cut back or stopped spending, we arrive at an overall “sales at risk” of 6.1%. This “sales at risk” figure ranges from 3% in Japan to 11% in India.

- “Sales at risk” (currency). To translate those percentages into currency, we then multiply the “sales at risk” percentages per country by household consumption numbers from The World Bank (in $US). Across 23 countries, we find a total of $3 trillion of “sales at risk” due to bad experiences, ranging from a low of $6 billion in Singapore to a high of $1.4 trillion in the U.S.

The Global Impact: $3.8 Trillion at Risk

Once we estimated “sales at risk” in 23 countries, we examined the impact of poor experiences globally. To do so, we again consulted the World Bank data. It turns out that our 23 countries represent 79% of global household consumption. If we assume that sales-at-risk data for the rest of the world are equivalent to that of our 23 countries, we conclude that there is $3.8 trillion of “sales at risk” from bad experiences in 2025. In total:

- Consumers will stop spending $811 billion with companies that provide very poor customer experiences.

- Consumers will reduce $2.18 trillion of their spending with companies that provide very poor customer experiences.

So What’s Changed?

About a year ago, we estimated that there was a global $3.7 trillion at risk from poor experiences. What’s different in 2025? We found that consumers are:

- Spending more. Since we published our previous analysis, the world’s total household consumption expenditure increased by slightly over $1 trillion – expanding the pool of revenue that can be put at risk.

- Reporting fewer bad experiences. The percentage of consumers who report having a bad customer experience dropped by 1.2 points since last year. Poor experiences have decreased the most among electronics makers (-8 pts), auto dealers (-4 pts), and property insurers (-3 pts).

- Reacting more severely to poor experiences. Across the 20 industries surveyed over both years, the percentage of poor interactions after which consumers stopped or reduced spending has increased by 2.7 points. The largest increases come from consumers cutting spending with department stores (+14 pts), followed by streaming services (+12 pts) and online retailers (+11 pts).

The bottom line: Bad experiences come with a (growing) cost.

Footnote 1: Global Study: Bad Experiences Across 20 Industries, 2025